About Us

Welcome to Prosperise Capital

We are a global asset manager who operates out of the US, Italy, and UK

With unparalleled expertise in corporate credit, fixed income and distressed debt, we have proven to generate rewarding opportunities for investors. Prosperise is at the forefront of financial innovation and excellence.

- Professional team

- Providing individual services to our investors

- Financial innovation and excellence

- Commitment to our vision

- Wide-ranging investment experience

- Rewarding opportunities

Regulated Entity

Prosperise Capital is authorized and regulated by the Financial Conduct Authority (FCA) in the UK and stands committed to its vision of enhancing its offerings and footprint in the financial realm.

Experienced Team

Our Team has a long term work experience in international credit and real estate markets and in the asset management industry.

Satisfied Clients

As a professional and regulated investment firm we help our clients to grow wealth. We have a well proven track record and repeating satisfied investors.

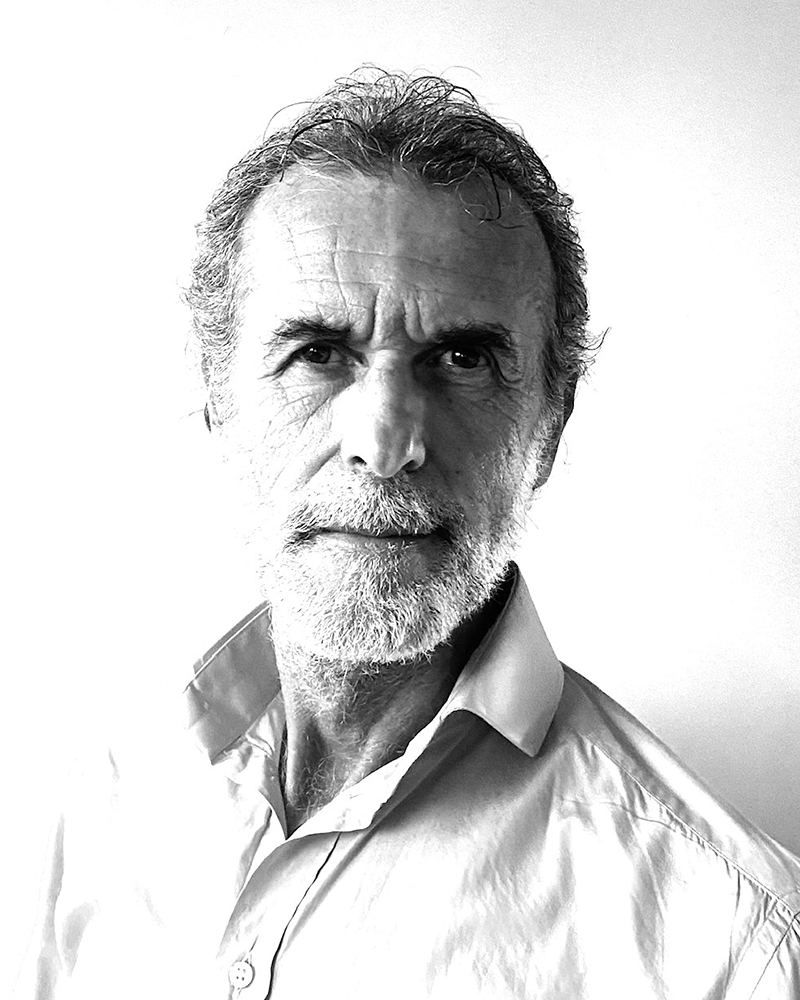

Meet Our Expert Team

The team’s wide-ranging investment experience of over 100 years encompasses distressed credit, performing and non-performing loans direct lending, structured and securitized assets, commercial real estate, real assets carbon credit, as well as fundamental and quantitative credit research. Recent expansion has brought signficant experience in the exiting and expanding world of ESG and Carbon Credit markets.

Each member has experience in at least one full credit cycle and is an expert in their market. The team has a culture of adaptability aiding the generation of new rewarding opportunities.

Our Approach

Prosperise invests using fundamental credit expertise in three contiguous business lines:

- liquid credit

- structured credit

- private credit

- Commercial Real Estate

- Real Asset Carbon Credit

Being involved in all of these different markets allows us identify patterns and relationships to make the best decisions for our investors that cannot be realized by single market participants.

Timeline

- 2023: Prosperise Capital enters US market with PC2 Capital

- 2022: Walter Dolhare and Dirk Rothig joined as new Partners

- 2018: Prosperise Capital Launched

- 2016: Best Long Term Credit Performance (5y minimum) – Special Situations Credit Account – Investors Choice Awards

- 2016: Best Performing Credit UCITS Fund (2y period) – PVE Credit Value Fund – HedgeFund Journal

- 2015: Best Performing Credit UCITS Fund – PVE Credit Value Fund - HedgeFund Journal

- 2015: PVE enters the Italian NPL market – European Distressed Fund 1 & 2 – private credit funds

- 2014: Best Overall Credit (Highly Commended) – Special Situations Credit Account – HFM Awards

- 2014: Pearl Vega Fund launched on Sciens Group hedge fund platform

- 2013: PVE Credit Value UCITS Fund starts trading

- 2013: Best Newcomer Credit – Special Situations Credit Account - HFM Awards

- 2011: Best Multi-Strategy Credit Manager awarded by Hedge Week

- 2011: Special Situations Credit Account inception – a 7-year closed-end managed account

- 2009: PVE Capital founded – one of a handful of credit funds to launch during the credit crisis